VCSEL Market Overview

At present, the world’s major designers include Finsar, Lumentum, Princeton Optronics, Heptagon, IIVI and other companies, which are at the forefront of R&D roles on the mobile VCSEL. III-V EPI epitaxial wafers are supplied by companies such as IQE, PAM-XIAMEN, VPEC and Landmark Optoelectronics, and then wafer fabrication is performed by companies such as AWSC (Principal Optronics) and WIN Semiconductors (Heptagon partners). The sealing and testing of companies such as silicon products has become a stand-alone VCSEL device. It is then provided by design companies to integrated solutions companies such as STMicroelectronics, Texas Instruments, and Infineon, and then to downstream consumer electronics manufacturers.

VCSEL manufacturing relies on MBE (molecular beam epitaxy) or MOCVD (metal organic vapor phase deposition) processes to grow multiple reflective and emissive layers on GaAs wafers(about 80% share) or InP wafers(about 15% share), for instance, Xiamen Powerway Advanced Material Co., Ltd, a VCSEL epitaxial wafer manufacturer providing VCSEL products in the 850-940nm band, in which the VCSEL chip has a photoelectric conversion efficiency of 40%, its process is mainly using GaAs substrate to epitaxy. The mobile VCSEL industry chain is similar to the compound semiconductor industry chain structure.

Domestic VCSEL start-ups are booming and veteran manufacturers are making slow progress

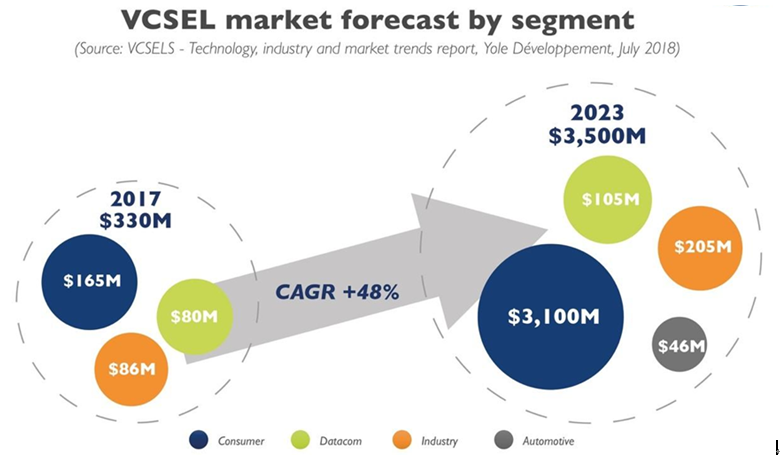

According to market research organizations, the global market for VCSEL chips will grow from 5.5 billion yuan in 2015 to 14.7 billion yuan in 2020, with a compound annual growth rate of 21.9%. Among them, the chip for 3D sensing is about 1 billion pieces per year, and the growth rate is over 100%. The performance improvement of the chip and the iteration of the integration method ensure that the upstream and downstream partners occupy the optoelectronic device market of more than RMB 30 billion.However, in China, about 500 million mobile phones are shipped annually, laser sensor chips are not yet available in China, including proximity sensors, laser focusing, 2D infrared lighting, and 3D sensing. In addition to the epitaxial embargo and mass production process, VCSEL chips are only about 10 billion RMB in the blank market in China’s smart phone field.Driven by a strong market and affected by the country’s strong support for the semiconductor industry development policy, a large amount of capital has flooded into this industry, and VCSEL companies that promote their own chips have sprung up. Old optical communication manufacturers are also stepping up research and development of related products.

VCSEL is not only a market opportunity seen by the capital market. For domestic manufacturers, the technical control of global leading manufacturers is an insurmountable barrier to their development. How to cultivate the entire industrial ecology from design, manufacturing, talents and other aspects should be worth pondering.

KeyWords: vcsel structure, vcsel wafer manufacturers, vcsel laser, vcsel manufacturers,vcsel applications, vcsel array, how does a vcsel work, vcsel vs led, vcsel wavelength, vcsel finisar, vcsel display, vcsel, laser diode, vcsel laser diode,laser diode array, laser diode driver, vcsel wafer, vcsel epitaxial wafers

For more information, please visit our website: https://www.powerwaywafer.com,

send us email at angel.ye@powerwaywafer.com or powerwaymaterial@gmail.com.